Alexandria Real Estate's Promising 2024 Performance: A Dividend Opportunity

March 30, 2025 - 20:36

Alexandria Real Estate has demonstrated impressive financial stability and growth in its 2024 performance, particularly highlighting solid funds from operations (FFO) per share growth alongside high occupancy rates. This performance positions the company as a strong contender in the real estate investment sector, particularly for investors seeking dividend bargains.

The company reported a significant increase in FFO, showcasing its ability to generate income while maintaining a robust portfolio of properties. High occupancy rates further underscore Alexandria's effective management and appeal in the competitive real estate market, particularly in the life sciences and biotechnology sectors.

As investors look for reliable income-generating assets, Alexandria Real Estate stands out due to its strategic positioning and strong operational metrics. The combination of growth in FFO and high occupancy levels paints a promising picture for future earnings, making Alexandria Real Estate stock an attractive buy for those seeking both growth and dividends in their investment strategy.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

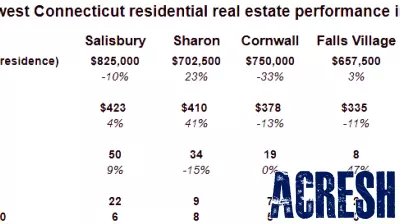

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...