Central Texas Housing Market Expected to Remain Stable in 2024

February 24, 2025 - 21:51

Experts predict a stable year for the Central Texas housing market as buyers and sellers adapt to the current higher mortgage interest rate environment. With interest rates remaining elevated, many prospective homeowners are adjusting their expectations and strategies, leading to a more balanced market.

Real estate analysts note that while higher rates can dampen demand, they also encourage sellers to price their homes more competitively, creating opportunities for buyers. This shift is expected to stabilize home prices, which have seen significant fluctuations in recent years.

Additionally, the region's strong job market and population growth continue to support housing demand, even in the face of rising costs. Experts believe that the Central Texas market will find its footing as both buyers and sellers become more accustomed to the new financial landscape.

Overall, the outlook for the Austin-area housing market remains positive, with stability anticipated throughout the year.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

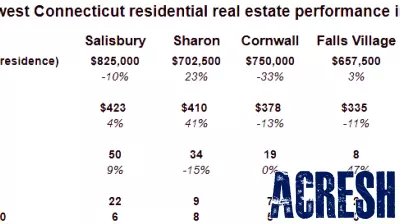

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...