Global Real Estate Stocks Poised for Strong Performance in 2025

March 29, 2025 - 21:13

In 2025, CBRE Investment Management forecasts a promising outlook for global listed real estate, suggesting that it may outperform broader equity markets. This anticipated performance is attributed to the unique characteristics of real estate investments, which can provide a differentiated total return compared to private market assets.

As economic conditions evolve, investors are increasingly looking towards listed real estate as a viable option for portfolio diversification. The potential for stable income generation, coupled with capital appreciation, makes these investments particularly appealing in a fluctuating market environment. Furthermore, the liquidity of publicly traded real estate allows investors to adjust their positions more readily than in the private sector.

Market analysts indicate that factors such as demographic shifts, urbanization, and evolving work patterns will drive demand for real estate assets. As a result, investors are advised to consider the strategic advantages of incorporating global real estate stocks into their investment strategies in the coming years.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

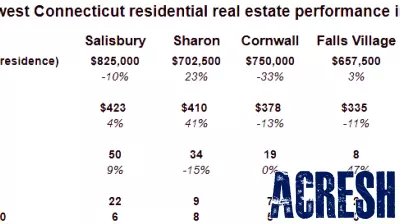

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...