Investors Seek Diverse Strategies Amid Economic Uncertainty

March 20, 2025 - 20:02

As global economies descend into a trade war, investors and managers are prioritizing a greater mix of strategies to navigate through uncertainty. The current climate of volatility has prompted a shift in the approach to private real estate investments. Traditionally viewed as a stable asset class, real estate is now being reevaluated as investors seek to hedge against potential downturns and market fluctuations.

With rising interest rates and inflationary pressures, many are looking to diversify their portfolios beyond conventional property investments. This includes exploring alternative sectors such as logistics, healthcare, and renewable energy facilities, which are seen as more resilient in challenging economic times.

Furthermore, the emphasis on sustainability is driving interest in green building practices and energy-efficient developments, aligning investment strategies with broader environmental goals. As the landscape continues to evolve, the ability to adapt and implement diversified strategies will be crucial for investors aiming to mitigate risks and seize emerging opportunities in the private real estate market.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

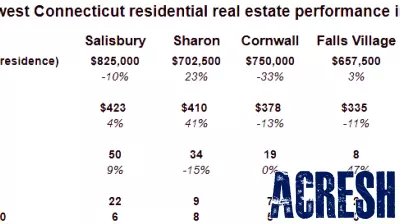

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...