Navigating Capital Gains Tax on Home Sales After the Loss of a Spouse

August 3, 2025 - 02:20

Selling a home after the death of a spouse can be an emotional and challenging process, especially when it comes to understanding the implications of capital gains tax. When a couple owns a home together, they often benefit from certain tax exemptions. However, the situation changes when one spouse passes away.

In general, homeowners can exclude up to $500,000 in capital gains from the sale of their primary residence if they file jointly. If your spouse has died, you may still qualify for this exclusion, provided you meet specific criteria. The key is to determine the property's value at the time of your spouse's death, as this can significantly affect your taxable gain when you sell the home.

Additionally, if the home was inherited, you may benefit from a "step-up" in basis, which adjusts the property's value to its current market rate, potentially reducing your capital gains tax liability. It’s essential to consult a tax professional to navigate these complexities and ensure you make informed decisions during this difficult time.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

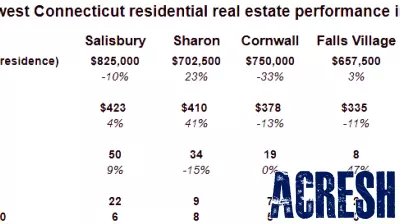

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...