The Impact of Government Job Cuts on Local Real Estate Markets

February 12, 2025 - 04:52

Recent cuts to government jobs and contracts are causing ripples in local real estate markets, raising concerns among homeowners and potential buyers alike. As government employment decreases, the disposable income of affected workers is likely to decline, leading to reduced demand for housing. This shift can create a surplus of available properties, ultimately driving down home prices in certain areas.

Additionally, the elimination of contracts with local businesses can further exacerbate economic challenges. Many small businesses depend on government contracts for a significant portion of their revenue, and job losses can lead to decreased spending in the community. This economic contraction may discourage new developments and renovations, impacting the overall attractiveness of neighborhoods.

Real estate professionals are closely monitoring these trends, as the long-term effects of these cuts may reshape the landscape of local housing markets. Stakeholders are urged to stay informed and adapt to the evolving economic environment to navigate potential challenges effectively.

MORE NEWS

January 9, 2026 - 20:44

Discovering $875,000 Homes in the BahamasThe Bahamas is known for its stunning landscapes and vibrant culture, and for those looking to invest in real estate, there are appealing options available at the price point of $875,000. Among...

January 8, 2026 - 20:13

Texas Firm Unveils Ambitious Luxury Senior Housing Project Near Las VegasA Texas-based real estate company has announced plans for a remarkable $100 million luxury senior housing development in Henderson, Nevada, just outside Las Vegas. This project aims to cater to the...

January 8, 2026 - 03:40

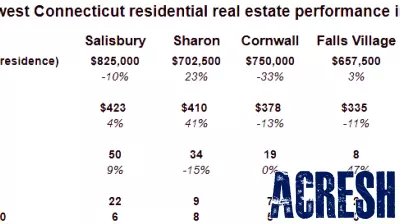

Diverging Real Estate Trends in the Northwest Corner for 2025In 2025, the Northwest Corner is showcasing a stark contrast to national real estate trends, with significant variations in housing performance across different towns. While the national median...

January 7, 2026 - 17:03

Luxurious Manalapan Estate Now Available at a Reduced PriceIt`s a sunny Manalapan estate in the Sunshine State -- and now available for quite the discount. This opulent property, originally priced at an astonishing $134 million, has recently seen a...